How I Know When to Drop Collision & Comprehensive Auto Insurance

Although we refuse to admit it, everybody is occasionally guilty of holding on to things a little longer than they really should.

Although we refuse to admit it, everybody is occasionally guilty of holding on to things a little longer than they really should.

I often question the Honeybee?s motives regarding her proclivity to keep around old birthday cards and our kids? elementary school papers. If you?re interested, I?m sure she can show you the very first perfect score Matthew ever received on a spelling quiz he took in kindergarten. Never mind that our son is now a high-school sophomore ? or that our closet is getting really full.

Whenever I ask the Honeybee why she refuses to toss stuff like that in the trash after all these years, she always comes back with the same frustrating response: ?Hey, you never know.?

I guess that?s true, but it defies all sense of reason.

Before you accuse me of throwing rocks from my glass house, I realize I?ve got my own issues with being unable to let go, too.

I remember the time I stubbornly refused to part company with my trusty ? but very old ? barbecue grill, even though it was clearly ready for the scrap heap.

Don?t laugh, ladies. The truth is, most guys tend to get attached to their barbecue grills the same way they get attached to their dogs. It?s practically a law of nature, as sure as the sun rises in the east and sets in the west.

I know a lot of folks make the same mistake when it comes to keeping the collision and comprehensive coverage on their auto insurance ? especially people like myself who drive older cars. Don?t think I didn?t keep that in mind earlier this month when I was renewing the insurance my 1997 Honda Civic and 2001 Honda Odyssey.

We all need liability insurance, which?protects us from damage we do to others or their property. However, that?s not necessarily true for collision and comprehensive insurance which covers:

- repairs or replacement to your car if you?re in an accident that?s your fault.

- losses caused by theft, vandalism, natural disasters, and other events.

Why? Because oftentimes the potential benefits derived from insurance may not be worth the premiums when compared to the actual risk.

Of course, that requires making a few assumptions and then running the numbers.

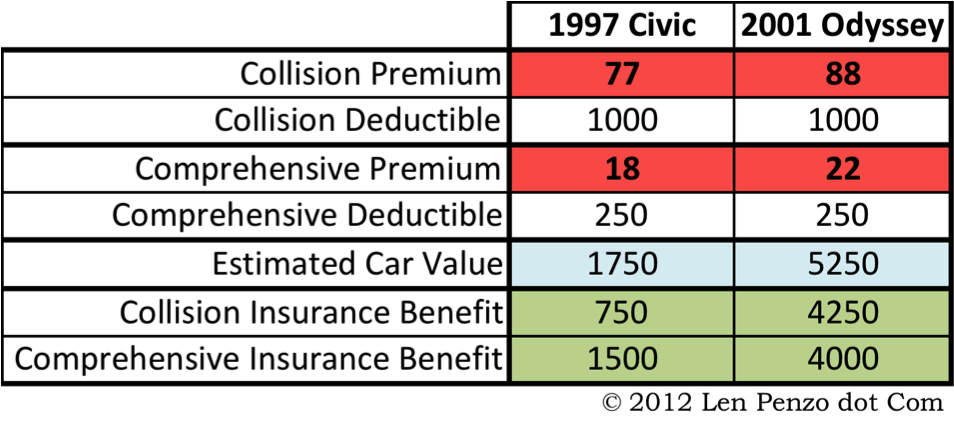

To help me make my decision, I used a spreadsheet to summarize the comprehensive and collision premiums my insurance company was offering on each vehicle, and evaluate the potential coverage benefits. Here?s what it looked like:

Before I could make a proper analysis on whether or not comprehensive and collision insurance was worth the price, I had to determine the replacement costs of the vehicles being insured. I used the Kelly Blue Book private-party sale figures to help estimate the value of both my cars. For the 2001 Odyssey, that?s approximately $5250.

The next step was to determine the actual benefit of each type of insurance. I determined those values by subtracting the applicable deductibles from the vehicle replacement costs. For example, the Odyssey?s collision insurance benefit was $4250.

Now here?s where the rubber meets the road. Based upon an annual collision premium of $88, it would take about 48 years ($4250/$88) before the total premiums paid would surpass the Odyssey?s replacement cost. Whether that is a good deal ? or not ? depends on how often I expect to get into an accident that would total the vehicle.

In my family?s case, our driver accident rate is, conservatively, roughly once every 20 years. As a result, I decided to keep the coverage on the Odyssey since I would expect to pay, at that premium, slightly less than half the mini van?s total replacement cost over that time period before making a claim. I kept the comprehensive insurance on the Odyssey for the same reason.

As for my trusty Civic, well, that was a different story. After running the numbers, I decided to drop the collision insurance because, with an annual collision premium of $77, and a potential insurance benefit of just $750, it would take less than 10 years before the premiums paid to the insurance company surpassed the car?s replacement value ? a period far shorter than our historical driver accident rate of once every 20 years.

Naturally, before estimating your personal accident rate, you?ll want to take into account changing factors including your past and future driving habits. For example, if you expect to begin racking up more miles because of a longer commute, it may make sense to assume that your risk of getting into an accident will increase somewhat.

On the other hand, you may be able to assume your accident rate will actually decrease if you?ve become a more defensive and responsible driver over the years ? or if you plan on winning the lottery and becoming wealthy enough to eventually hire a chauffeur.

Hey, you never know.

Photo Credit: Commodore Gandalf Cunningham

Source: http://lenpenzo.com/blog/id16369-how-i-know-when-to-drop-collision-comprehensive-auto-insurance.html

wilson chandler bristol motor speedway prometheus grand canyon skywalk tonga pid corned beef hash

0টি মন্তব্য:

একটি মন্তব্য পোস্ট করুন

এতে সদস্যতা মন্তব্যগুলি পোস্ট করুন [Atom]

<< হোম